The Abraaj Group is a private equity investing firm operating in the growth markets of Africa, Asia, Latin America, Middle East and Turkey operating from Dubai. The Abraaj has announced that it will be spending up to $500 million in start-up capital for a mid-tier hospital business in Africa, tapping into demand from the continent’s emerging middle classes.

Founded in 2002 by Arif Naqvi, the Abraaj group has over 20 offices spread across five regional hubs in Istanbul, Mexico City, Dubai, Nairobi and Singapore. Abraaj currently manages c.US$9 billion in assets globally.

In April 2015, the firm closed a $990 million sub-Saharan Africa fund, its third in the region according to the company. Combined with $375 mln raised in August 2015 for a fund that will focus on North Africa, the two funds give Abraaj just under $1.4bn to invest in Africa, a record sum raised in a single year

Abraaj partner Sev Vettivetpillai said the group was well on the way to securing land for a 350-bed multi-speciality hospital in the Nigerian commercial capital Lagos, as well as buying several hospitals in Nairobi to form a healthcare ‘cluster’.

Its other two target cities are Addis Ababa and Johannesburg.

“We’re looking to build from the ground up because the assets do not exist,” Vettivetpillai said during an interview on the sidelines of the World Economic Forum on Africa in Rwanda.

Besides its own equity, Abraaj is looking to attract other investors, meaning that the first four target cities were likely to absorb at least $1 billion between them.

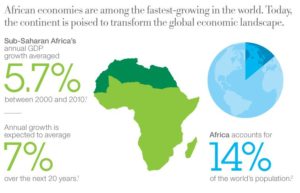

Even though most African countries have one or two high-end hospitals, governments are struggling to provide adequate healthcare for the vast majority of their citizens, despite a decade of rapid growth across the continent.

, a private equity investing firm operating in the growth markets of Africa, Asia, Latin America, Middle East and Turkey operating from Dubai, has announced that it will be spending up to $500 million in start-up capital for a mid-tier hospital business in Africa, tapping into demand from the continent’s emerging middle classes.

Founded in 2002 by Arif Naqvi, the Abraaj group has over 20 offices spread across five regional hubs in Istanbul, Mexico City, Dubai, Nairobi and Singapore. Abraaj currently manages c.US$9 billion in assets globally.

In April 2015, the firm closed a $990 million sub-Saharan Africa fund, its third in the region according to the company. Combined with $375 mln raised in August 2015 for a fund that will focus on North Africa, the two funds give Abraaj just under $1.4bn to invest in Africa, a record sum raised in a single year

Abraaj partner Sev Vettivetpillai said the group was well on the way to securing land for a 350-bed multi-speciality hospital in the Nigerian commercial capital Lagos, as well as buying several hospitals in Nairobi to form a healthcare ‘cluster’.

Its other two target cities are Addis Ababa and Johannesburg.

“We’re looking to build from the ground up because the assets do not exist,” Vettivetpillai said during an interview on the sidelines of the World Economic Forum on Africa in Rwanda.

Besides its own equity, Abraaj is looking to attract other investors, meaning that the first four target cities were likely to absorb at least $1 billion between them by 2021.

Even though most African countries have one or two high-end hospitals, governments are struggling to provide adequate healthcare for the vast majority of their citizens, despite a decade of rapid growth across the continent.