As Middle East countries continue to invest in Africa, an increasing number of businesses based in the GCC are seeking business and investment opportunities in African nations. Here are some latest developments…

Some of the major deals and investments between Africa and the Middle east countries:

Abu Dhabi’s Royal Group leads infrastructure drive in West Africa

• Trojan General Contracting, part of the Royal Group owned by HH Sheikh Tahnoon bin Zayed Al Nahyan of the Abu Dhabi Royal Family, committed to equity participation in $16 billion worth of road and rail projects across the region at the West Africa Investment Forum, alongside Earth Capital Partners.

$1.98 billion: Essar Projects commits to projects in Benin, Guinea-Bissau and Niger

• Essar Projects, UAE subsidiary of the Mumbai-based Essar Group committed to road projects worth $1.98 billion including an airport in Benin, a bridge at Farim in Guinea-Bissau and the construction of a coal-powered power plant in Salkadamna, Niger.

$700 million: Hasan Juma Backer agrees to develop dry-port in Côte d’Ivoire

• Oman’s Hasan Juma Backer Trading & Contracting agreed to develop a $700 million dry-port in Ferkessedougou, Côte d’Ivoire. The project is part of the rehabilitation of a trunk road from the Port of Abidjan to the country’s northern border at Ouangolo.

$506 million: QNB raises Ecobank stake to become largest shareholder

• Qatar National Bank raised its Ecobank stake to 23.5% in a transaction worth $283 million, weeks after its initial deal to acquire a 12.5% stake in the Lagos-listed bank through a combination of ordinary shares and convertible preference shares in a deal thought to be worth $223 million.

$500 million: Kuwait bank leads first sovereign sukuk in South Africa

• Kuwait Finance House led the launch of the first sovereign sukuk in South Africa through its Investment arm KFH-Investment, listing the product on the Luxembourg Stock Exchange alongside BNP Paribas and Standard Bank with a period of 5 years and 9 months, with an expected return of 3.9 per cent.

$400 million: Etisalat negotiates sale of mobile towers to IHS Nigeria

• In a strategic move, Etisalat Nigeria has declared its intention to sell 2,136 of its communication towers to IHS Nigeria – Africa’s largest independent phone tower company. The company palns to lease the towers back for its network, as part of strategic plans to raise network performance and also roll-out 2G and 3G across Nigeria.

$300 million: Dubai sovreign wealth vehicle ICD buys into Dangote Cement

• The Investment Corporation of Dubai (ICD), an investment vehicle for Dubai’s sovereign wealth fund, has acquiring a 1.4 per cent minority interest in Dangote Cement, Nigeria’s largest traded company by market capitalisation and the largest cement manufacturer on the continent, of the Dangote Group.

$50 million: Al Ghurair forms partnership on aluminium plant in Ethiopia

• Dubais’ Al Ghurair Group has finalised plans to establish an aluminium refinery in Ethiopia in a 50:50 partnership with local partner Tracon Trading, in the Lebu area of the capital of Addis Ababa, with an initial production capacity of 25,000 to 30,000 tonnes of aluminium expected to begin within a year.

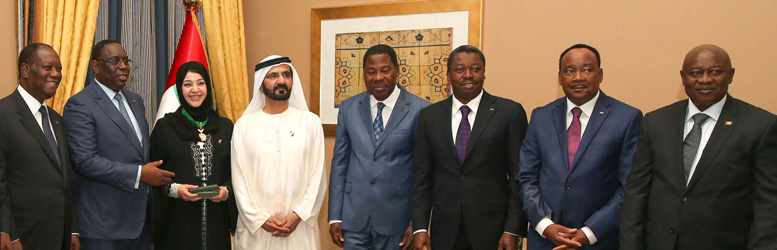

$49 million: UAE Water Aid raises funds to water seven million people

• Last year’s Water Aid campaign was co-ordinated and conducted by the UAE Red Crescent and spearheaded by HH Sheikh Mohammed bin Rashid Al Maktoum, Ruler of Dubai, raising $49 million in sixteen days. The funds were utilised for drilling much needed wells in rural areas of Tanzania, Niger, Togo and Ghana, and helping refugees in Somalia and Sudan.

$18 million: Abu Dhabi confirms funding for $18 million solar project in Sierra Leone

• The Abu Dhabi Fund for Development is part funding an $18 million solar park in Sierra Leone’s capital Freetown selected by the International Renewable Energy Agency under a seven-year cycle of loans. Abu Dhabi’s Masdar PV will manufacture the photo-voltaic solar panels for the project.