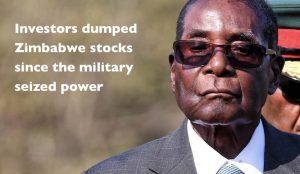

Investors dumped Zimbabwe stocks since the military seized power in the country on November 15 making the stock market to shed nearly a third of its value in a week.

For a while, the Zimbabwe Stock Exchange looked unstoppable. A record-breaking bull run, fueled by inflation-weary investors seeking refuge in stocks, propelled the market to a peak of about 15 billion dollars in early November.

Analysts expected a self-correction to cap the spectacular run but November’s military operation has only accelerated matters.

Zimbabwe is on the cusp of a new economic revolution after the departure of Robert Mugabe

“To date I think we have lost north of four billion in terms of market capitalization. Are we still going down in my view? Yes, there is still a lot of down side. We believe the market is going to bottom down somewhere inside of 10 billion, and we still have a few days more to go before we see stability coming back to the market,” said Farai Vengesai, an investment analyst for Zimbabwe’s Akribos Capital.

Some foreign-owned businesses have taken precautionary measures to safeguard their human and capital assets. But despite initial fears, most have remained open and are trading as normal.

Impending changes on the political landscape could lure investors with a long-term focus

Vengesai said this very good for companies at the long term.

“Right now we are staring into real possibilities possibilities that probably will see changes on the policy front. There are possibilities that we might actually see changes on the indigenization front, tax laws and so forth,” he added.

With Robert Mugabe resigning as president, the new administration will face the massive challenge of addressing the festering issues that have plunged the country into the current economic crisis.

Under Mugabe, Zimbabwe has largely been isolated by the international community and has struggled to attract significant foreign investment. Experts are hoping a change of guard in the government will also bring change to the economy.